Choosing the right ETF can make investing simple, low-cost, and stress-free — especially for UK beginners. Exchange-Traded Funds (ETFs) allow you to invest in hundreds or even thousands of companies through a single purchase, making them one of the most popular ways to grow wealth long-term. In this guide, we break down the 4 best ETFs in the UK, ranked by affordability, diversification, performance, and suitability for beginners. Whether you’re building an ISA portfolio, starting your first investment plan, or looking for a reliable long-term holding, these ETFs — including VWRP, ISF, VUSA, and SWDA — offer strong global and UK market exposure with low fees and simple maintenance. Let’s explore why these funds are top choices for UK investors.

Best ETFs to Buy in the UK

VWRP - Vanguard FTSE All-World UCITS

ISF -iShares Core FTSE 100 UCITS ETF

VUSA - Vanguard S&P 500 UCITS ETF USD Dis

SWDA: iShares Core MSCI World UCITS ETF

Comparison Table – 4 Popular UK-Listed ETFs

| Feature | VWRP | ISF | VUSA | SWDA |

|---|---|---|---|---|

| Full Name | Vanguard FTSE All-World UCITS ETF (Acc) | iShares Core FTSE 100 UCITS ETF (Inc) | Vanguard S&P 500 UCITS ETF (Dist) | iShares Core MSCI World UCITS ETF (Acc) |

| Index Tracked | FTSE All-World | FTSE 100 | S&P 500 | MSCI World |

| Geographic Exposure | Global (Developed + Emerging Markets) | UK only | US only | Global (Developed Markets only) |

| Number of Holdings (approx.) | ~3,600 | 100 | ~500 | ~1,600 |

| Diversification Level | Very high | Low | Medium | High |

| Emerging Markets Included? | Yes | No | No | No |

| Income Type | Accumulating (reinvests dividends) | Distributing (pays dividends) | Distributing (pays dividends) | Accumulating (reinvests dividends) |

| OCF (Fee) | ~0.19% | ~0.07% | ~0.07% | ~0.20% |

| Replication Method | Physical (optimised sampling) | Physical | Physical | Physical |

| Typical Use Case | One-stop global equity solution | UK equity / income bias | US market exposure | Global developed-market core holding |

| Currency (LSE Trading) | GBP | GBP | GBP | GBP |

| Risk Level | Global equity risk (broad) | Single-country risk (UK only) | Single-country risk (US only) | Global developed-market risk |

| Sector Exposure Style | Balanced across global sectors | Heavy in energy, financials, consumer staples | Heavy in tech, communication, consumer discretionary | Similar to VWRP but no EM, so more developed-market heavy |

What Is an ETF?

An ETF, or Exchange-Traded Fund, is a type of investment fund that lets you buy a large basket of assets—such as stocks, bonds, or commodities—in one single purchase. Instead of picking individual companies like Apple or Tesco, an ETF allows you to instantly own small pieces of hundreds or even thousands of companies. This makes ETFs one of the easiest and safest ways for beginners to start investing.

ETFs trade on the stock market just like regular shares, so their price moves throughout the day. They are popular among UK investors because they are simple, low-cost, and highly diversified, meaning your money is spread across many companies, reducing risk.

Most ETFs in the UK follow UCITS regulations, which add extra protections for investors. You can also choose between accumulating ETFs (which automatically reinvest dividends) or distributing ETFs (which pay dividends out to you). Overall, ETFs offer an easy, hands-off way to grow wealth over the long term.

How We Chose the 4 Best ETFs in the UK

Choosing the best ETFs for UK investors requires more than just looking at past performance. In this guide, each ETF was selected using clear, objective criteria to ensure they are suitable for both beginners and long-term investors. First, we focused on popularity and trust, choosing ETFs widely used by UK investors and available on major platforms like Vanguard, Trading212, Freetrade, and Hargreaves Lansdown. We also prioritised low fees (TER), since lower costs help investors keep more of their returns over time.

Next, we analysed diversification, favouring ETFs that offer broad exposure across global markets, the UK economy, or major sectors like the US S&P 500. Liquidity and fund size were also crucial, ensuring the ETFs are stable, well-established, and easy to buy or sell. Finally, we considered risk level, long-term consistency, and suitability for ISA portfolios. Together, these factors helped identify the four ETFs—VWRP, ISF, VUSA, and SWDA—as the strongest options for UK investors in 2025.

VWRP – Vanguard FTSE All-World UCITS ETF (Accumulating) – #1 Overall

VWRP is one of the most popular and reliable ETFs among UK investors because it offers a complete global investment in a single fund. It tracks the FTSE All-World Index, which includes over 3,700 companies from both developed and emerging markets. This means you get exposure to major economies like the US, UK, Europe, and Asia, along with fast-growing markets such as India and Brazil.

One of VWRP’s biggest advantages is that it’s an accumulating ETF, meaning all dividends are automatically reinvested back into the fund. This helps your investment grow faster through compounding—ideal for long-term portfolios and ISA investors. While its fee (TER 0.22%) is slightly higher than some developed-market ETFs, it offers far broader diversification and reduces reliance on any single country.

VWRP is perfect for beginners and long-term investors who want a simple, hands-off investment that covers the entire world in one purchase. If you only choose one ETF to hold for the next 10–20 years, VWRP is often considered the best all-round choice for UK investors.

ISF – iShares Core FTSE 100 UCITS ETF – #2 Best for UK Market Exposure

ISF is one of the most popular ETFs among UK investors because it provides simple, low-cost exposure to the FTSE 100—the index of the 100 largest companies listed on the London Stock Exchange. These are well-established, globally recognised businesses like Shell, AstraZeneca, HSBC, BP, Diageo, and Unilever. As a result, ISF offers investors stability and steady dividend potential, making it a core holding for those who want exposure to the UK economy.

One of ISF’s biggest strengths is its very low fee (TER 0.07%), making it ideal for long-term, cost-conscious investors. Many FTSE 100 companies also pay high dividends, so ISF is especially attractive for those seeking income or wanting a more balanced portfolio.

ISF is not as diversified as global funds like VWRP, and the UK market is more concentrated in sectors such as energy, banking, pharmaceuticals, and consumer goods. However, it remains a strong foundational ETF for UK investors who want home-market exposure, dividend strength, and long-term stability.

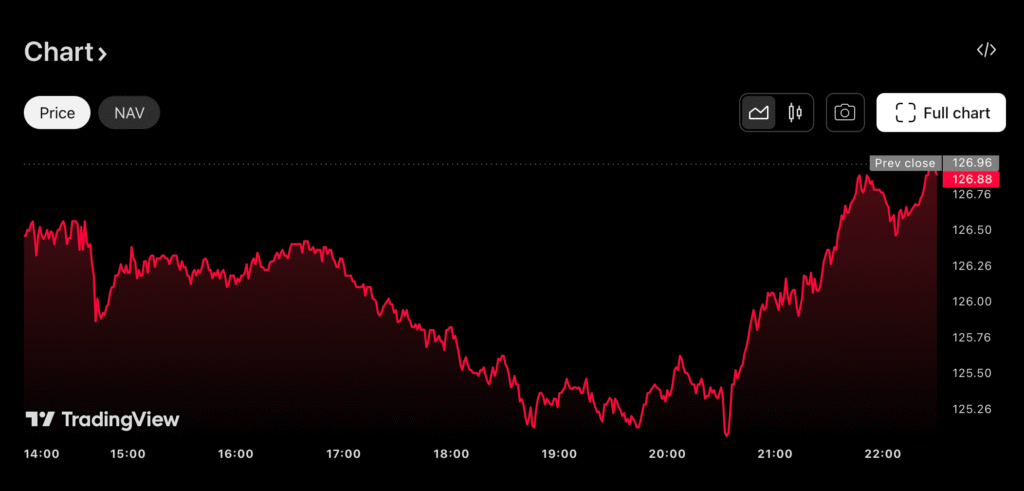

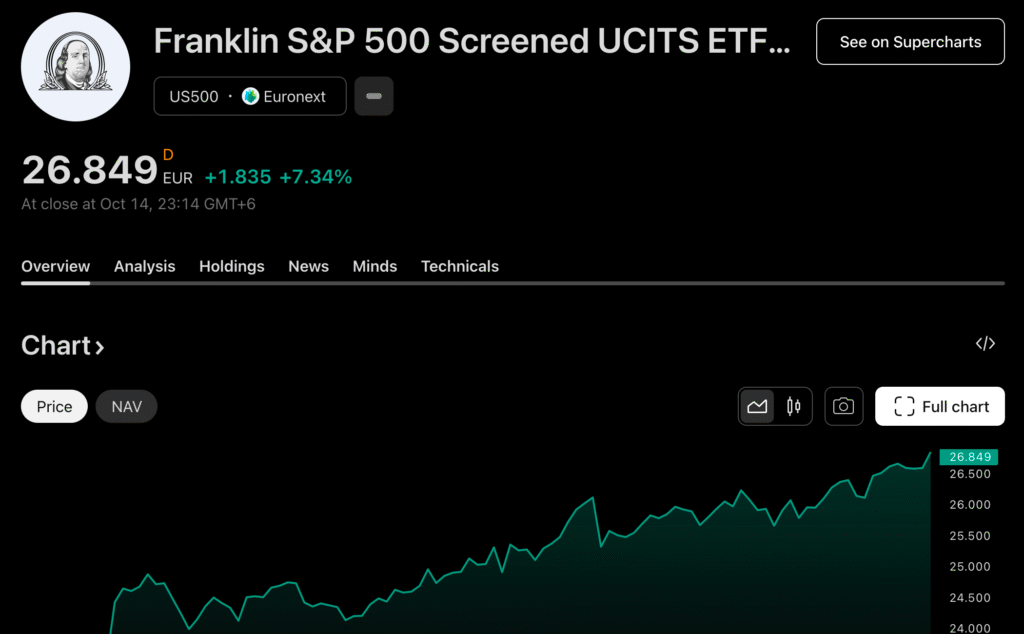

VUSA – Vanguard S&P 500 UCITS ETF – #3 Best for US Market Growth

VUSA is one of the most widely held ETFs among UK investors because it provides easy, low-cost exposure to the S&P 500, the index that tracks 500 of the largest companies in the United States. This includes many of the world’s most influential and high-performing companies such as Apple, Microsoft, Amazon, Nvidia, and Alphabet. Historically, the S&P 500 has delivered strong long-term growth, making VUSA a favourite for investors seeking reliable performance.

One of VUSA’s biggest appeals is its very low fee (TER 0.07%), allowing investors to benefit from strong US market growth without high costs. The ETF is well-diversified across multiple sectors, although it does lean heavily toward technology and large-cap companies.

For UK investors, the main consideration is currency risk, since the fund tracks US stocks priced in USD. This means the value of the pound can affect returns. However, many long-term investors see this as a reasonable trade-off given the strong performance of the US market over decades.

Overall, VUSA is ideal for investors who want simple, low-cost access to the world’s leading companies and long-term growth potential.

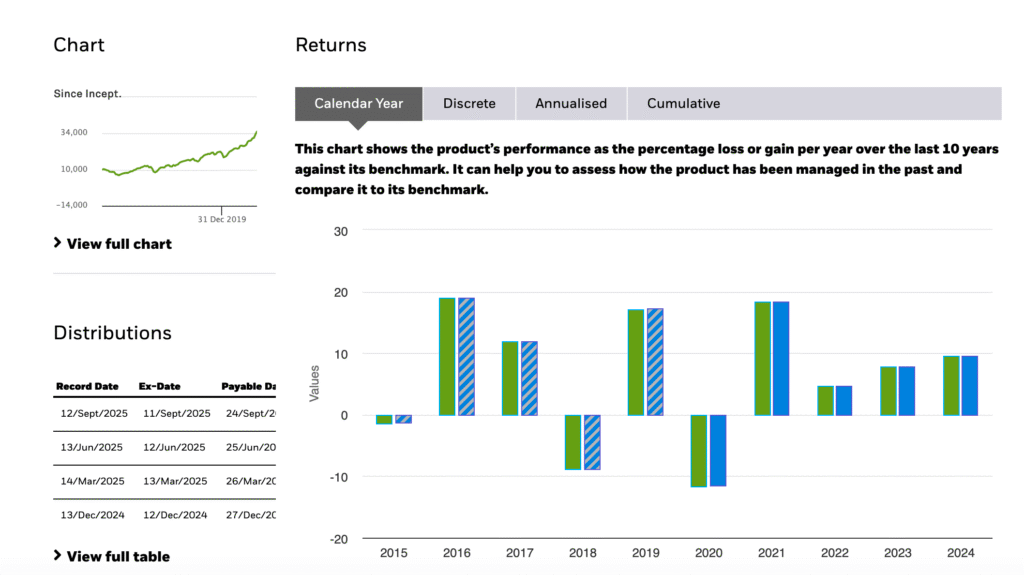

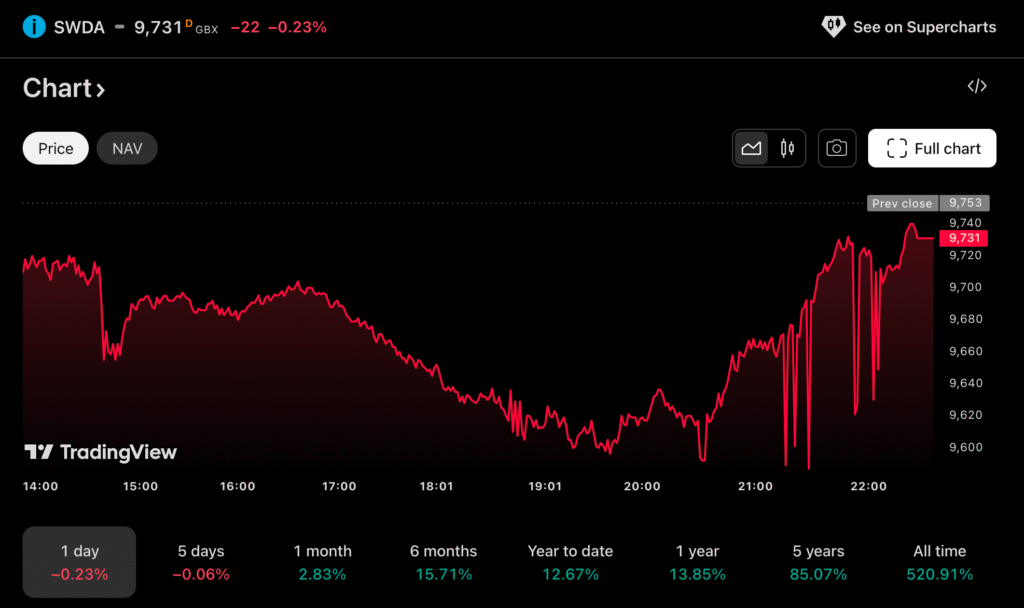

SWDA – iShares Core MSCI World UCITS ETF – #4 Best for Developed Markets

SWDA is one of the most popular global ETFs in the UK, offering broad exposure to 23 developed markets, including the US, UK, Europe, Japan, and Australia. Unlike VWRP, it does not include emerging markets, which makes it slightly less diversified but also more stable. With over 1,500 large and mid-cap companies, SWDA covers the strongest and most established economies in the world.

Its fee (TER 0.20%) is lower than many other global ETFs, making it attractive for long-term investors who want broad diversification at a reasonable cost. The fund is heavily weighted toward the United States, similar to many global ETFs, due to the dominance of US companies like Apple, Microsoft, Nvidia, and Meta.

SWDA is an excellent choice for UK investors who want a simple, reliable, and lower-risk global ETF without the volatility of emerging markets. It works well as a core holding in an ISA or long-term portfolio, especially for those who prefer investing in developed economies only.

Which ETF Is Best for You?

Choosing the best ETF depends on your goals, risk tolerance, and how hands-off you want your investing to be. If you want a simple, all-in-one global solution, VWRP is the strongest choice. It gives you exposure to almost every major market worldwide, making it ideal for beginners and long-term investors who prefer a “set it and forget it” approach.

If you want exposure to the UK stock market, particularly for dividend income, ISF is the most suitable option. It includes the FTSE 100’s largest and most stable UK companies.

If your focus is on US long-term growth, VUSA is the best pick. The S&P 500 has historically delivered strong returns, and this ETF offers access at a very low cost.

Finally, if you prefer developed markets only and want a simple global ETF with slightly less volatility, SWDA is a great choice. It excludes emerging markets while still providing broad diversification.

In summary:

Best Overall: VWRP

Best UK Exposure: ISF

Best US Growth: VUSA

Best Developed Markets: SWDA

ETF Investing for UK Beginners

ETF investing is one of the easiest and safest ways for beginners in the UK to start building long-term wealth. Unlike picking individual stocks, ETFs spread your money across hundreds or even thousands of companies, reducing your risk and making the process far simpler. Most UK beginners choose ETFs because they are low-cost, diversified, and easy to buy, especially through platforms like Trading212, Freetrade, Vanguard UK, Hargreaves Lansdown, and eToro.

One of the biggest advantages for UK investors is the Stocks & Shares ISA, which allows you to invest in ETFs without paying tax on profits or dividends. This makes ETFs particularly powerful for long-term compounding. Many beginners also use a DCA strategy (Dollar-Cost Averaging)—investing a fixed amount monthly—to smooth out market ups and downs.

It’s important to understand that ETFs still carry risk, and prices will go up and down. Choosing simple, globally diversified ETFs like VWRP or SWDA can help reduce volatility. Beginners should focus on long-term investing, ignore short-term noise, and stick to funds they understand.

Common Mistakes UK Investors Make With ETFs

Even though ETFs are beginner-friendly, many UK investors still make avoidable mistakes that can reduce their long-term returns. One common issue is over-diversification—buying too many ETFs that hold the same companies. For example, VWRP, VUSA, and SWDA all have heavy exposure to the US market, so holding all three may not provide as much extra diversification as you think.

Another mistake is focusing too much on short-term performance, especially when markets fall. ETFs are designed for long-term investing, and reacting emotionally to market dips can lead to buying high and selling low. Many beginners also misunderstand the difference between accumulating and distributing ETFs, accidentally choosing funds that don’t match their strategy.

Currency risk is another overlooked factor. Some ETFs price in USD even when listed in the UK, meaning exchange rates can affect your returns. Lastly, beginners sometimes forget to use a Stocks & Shares ISA, missing out on tax-free gains.

Avoiding these mistakes helps you build a simple, effective, long-term ETF portfolio.

Conclusion

Choosing the right ETF can make investing simple, low-cost, and highly effective for long-term wealth building. The four ETFs highlighted in this guide—VWRP, ISF, VUSA, and SWDA—offer UK investors a strong mix of global diversification, market-specific exposure, and low fees. Whether you want a single-fund global portfolio, UK-focused stability, US market growth, or developed-market simplicity, each ETF provides a reliable foundation for beginners and experienced investors alike.

The key to successful ETF investing is staying consistent, keeping your portfolio simple, and focusing on long-term goals. By using tax-efficient accounts like a Stocks & Shares ISA and following strategies such as monthly investing (DCA), you can grow your wealth steadily without needing to pick individual stocks or time the market.

In the end, ETFs remain one of the most beginner-friendly and powerful tools available to UK investors—and choosing the right ones can set you up for decades of growth.

FAQ – Best ETFs in the UK

1. What is the best ETF to buy in the UK?

For many UK investors, VWRP is considered one of the best all-in-one ETFs because it invests in thousands of companies worldwide and automatically reinvests dividends. It’s a popular choice for simple, long-term investing.

2. Can I buy ETFs in a Stocks & Shares ISA?

Yes. Most UK investing platforms allow you to buy ETFs inside a Stocks & Shares ISA. This makes all your gains and dividends from those ETFs tax-free, as long as they stay within your ISA allowance.

3. Are ETFs safe for beginners?

ETFs are generally safer than picking individual stocks because they are diversified across many companies. However, their value can still go up and down, so they are best used for long-term investing rather than short-term trading.

4. What’s the difference between VWRP and VUSA?

VWRP is a global ETF that invests in over 3,700 companies worldwide, across both developed and emerging markets.

VUSA only invests in the S&P 500, which is made up of 500 large US companies. VWRP is more diversified, while VUSA focuses on the US market.

5. What fees do ETFs charge?

ETFs charge a small annual fee called a TER (Total Expense Ratio). Typical ETF fees in the UK range from around 0.07% to 0.22% per year, depending on the fund. Lower fees help you keep more of your returns over time.

6. Should I choose accumulating or distributing ETFs?

Accumulating (ACC) ETFs automatically reinvest dividends back into the fund, which is ideal for long-term growth.

Distributing (DIST) ETFs pay dividends out to you in cash, which is better if you want regular income from your investments.

7. Are ETFs taxed in the UK?

Outside of an ISA, you may pay Capital Gains Tax on profits and Dividend Tax on payouts. Inside a Stocks & Shares ISA, gains and dividends from ETFs are generally tax-free.

8. How much should beginners invest in ETFs?

There is no fixed amount. Many beginners use a strategy called Dollar-Cost Averaging (DCA), where they invest a fixed amount monthly. This helps smooth out market ups and downs and builds a consistent investing habit.

9. Are ETFs risky?

All investing carries risk, and ETFs are no exception. However, because they spread money across many companies, they are generally lower risk than picking individual stocks. Global ETFs like VWRP are among the most balanced options for long-term investors.

10. Can I lose money in an ETF?

Yes. ETF prices can fall as well as rise, especially in the short term. They are designed for long-term investing, where temporary drops are normal. Over longer periods, diversified ETFs have historically delivered solid growth.

11. Which ETF is best for UK exposure?

ISF (iShares Core FTSE 100 UCITS ETF) is a popular choice for UK exposure. It tracks the FTSE 100 index, giving you access to the largest and most established UK companies.

12. Which ETF is best for long-term growth?

For long-term growth, many UK investors choose global and US-focused ETFs like VWRP (global) and VUSA (US S&P 500). Both offer broad exposure to strong, large-cap companies with good long-term performance histories.

13. What platform should I use to buy ETFs in the UK?

Popular UK platforms include Trading212, Freetrade, Vanguard Investor, Hargreaves Lansdown, and eToro. If you want tax-free investing, choose a platform that offers a Stocks & Shares ISA.

14. Is it okay to only invest in one ETF?

Yes. Many investors build their entire portfolio around a single, highly diversified ETF like VWRP or SWDA. These funds invest in many companies across multiple countries, so one ETF can provide plenty of diversification.

15. Should beginners avoid overlapping ETFs?

Yes, it’s usually best to keep things simple. Some ETFs hold many of the same companies. For example, VWRP, VUSA, and SWDA all include a lot of US stocks. Too many overlapping ETFs can complicate your portfolio without adding much extra diversification.