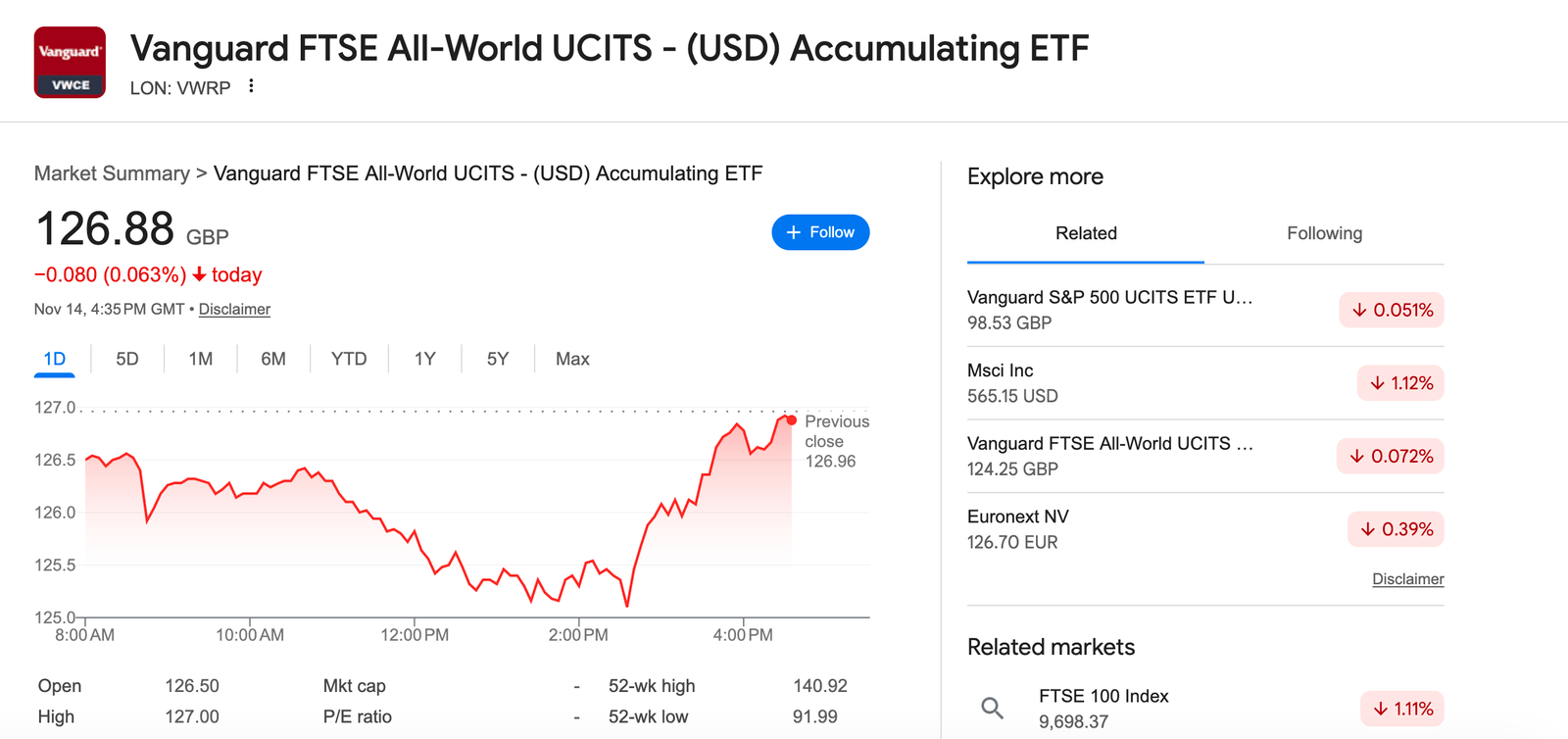

For UK investors seeking a simple, globally diversified, long-term investment, one exchange-traded fund (ETF) continually stands out: VWRP — the Vanguard FTSE All-World UCITS ETF (Accumulating). As passive investing grows in popularity and more people look for cost-effective, scalable, and hands-off investment options, VWRP has become one of the most prominent “one-fund portfolios” available on the London Stock Exchange.

The central question many investors ask is: Is VWRP a good investment?

The short answer for long-term, globally minded, cost-conscious investors is: VWRP checks almost every box.

Below, you’ll find a comprehensive exploration — about 2,000 words — of why many investors consider VWRP an exceptional investment product. This article will cover diversification, performance consistency, costs, accumulation mechanics, market exposure, investor psychology, risk considerations, and long-term wealth-building.

1. What Exactly Is VWRP?

VWRP is an ETF created by Vanguard, one of the world’s largest and most respected asset managers. It tracks the FTSE All-World Index, an index composed of large and mid-cap stocks across both developed and emerging markets.

In simple terms, VWRP gives you:

-

Exposure to more than 3,500 companies

-

Across 50+ countries

-

Representing ~98% of global stock market capitalisation

-

Automatically adjusted and rebalanced

-

At a very low annual cost

VWRP is also an accumulation ETF, meaning it reinvests dividends automatically, allowing investors to benefit from compounding without needing to reinvest distributions manually.

For many investors, this single fund offers a lifetime investment option requiring no additional management.

2. Global Diversification: The Core Strength of VWRP

One of the biggest reasons VWRP is considered such a solid investment is extraordinary diversification. Instead of trying to pick winning countries, industries, or companies, investors own everything — the entire investable global market.

2.1 Geographic Diversification

VWRP includes companies from:

-

United States (typically ~60%)

-

Europe (typically ~15%)

-

Japan (~7%)

-

China, India, Brazil, Taiwan, and other emerging markets

-

Canada, Australia, Singapore, Hong Kong, South Korea, and dozens more

This matters because economic growth is unpredictable. No single country dominates forever. Investing globally allows an investor to:

-

Benefit from growth wherever it happens

-

Reduce overexposure to one economy

-

Avoid the risks associated with political or economic shocks in a single region

2.2 Industry and Sector Diversification

VWRP contains exposure across all major industries:

-

Technology

-

Financial services

-

Healthcare

-

Consumer discretionary

-

Industrials

-

Energy

-

Utilities

-

Telecommunications

-

Real estate

Rather than attempting to guess which sectors will outperform, VWRP ensures exposure to every sector as global trends shift.

2.3 Company Size Diversification

While it focuses on large and medium-sized firms, VWRP spreads investment across:

-

Global mega-caps (Apple, Microsoft, Amazon, etc.)

-

Blue-chip companies worldwide

-

Fast-growing emerging market giants

-

Established multinational leaders

This balance reduces reliance on a handful of high performers and provides smoother long-term returns.

3. The Power of Passive Investing

Another vital reason investors choose VWRP is its passive management. Instead of trying to outperform the market, the ETF simply tracks the global market itself.

3.1 Why Passive Beats Most Active Investors

Decades of financial research show:

-

Most actively managed funds underperform the market over long periods

-

The primary reasons are higher fees, turnover costs, and market-timing errors

-

Very few active managers outperform consistently over 10–20 years

By investing in VWRP, one benefits from:

-

Market-level returns

-

Low turnover

-

Low management overhead

-

No reliance on a manager’s forecasting ability

3.2 Smooth, Stress-Free Investing

Because VWRP tracks the entire world market:

-

You do not need to research individual stocks

-

You do not need to time the market

-

You avoid emotional errors like panic-selling

-

You benefit from natural global economic growth

For long-term investors, passive investing reduces behavioural mistakes — often the single largest destroyer of returns.

4. The Unique Benefits of an Accumulating ETF

VWRP is part of the ACC share class, meaning dividends are automatically reinvested. This provides several advantages.

4.1 Compounding Without Effort

With accumulation ETFs:

-

Dividends buy more shares automatically

-

Those shares then earn dividends too

-

Growth compounds exponentially

This silent compounding effect is one of the most powerful wealth-building tools in investing.

4.2 Tax Efficiency in ISAs and SIPPs

UK investors enjoy a remarkable benefit:

-

Inside an ISA or SIPP, accumulation ETFs allow tax-free, hassle-free reinvestment

-

No dividend paperwork

-

No cash drag

-

No need to reinvest manually

This “set-and-forget” nature is why so many long-term UK investors favour accumulation share classes like VWRP.

4.3 Eliminating Cash Drag

Distributing ETFs leave cash sitting uninvested until you choose how to reinvest it. Accumulating ETFs keep your money working in the market continuously.

5. Costs Matter: Low Fees Make a Huge Difference

VWRP comes with a very competitive Ongoing Charges Figure (OCF). Low fees are one of the strongest predictors of long-term investment success.

Here’s why fees matter:

5.1 How Fees Impact Long-Term Wealth

Imagine two portfolios over 40 years:

-

Portfolio A charges 0.20%

-

Portfolio B charges 1.20%

With identical market performance, the high-fee fund could leave an investor with 40–60% less wealth after decades.

Even a seemingly small fee difference compounds heavily over time.

5.2 VWRP’s Low-Cost Advantage

As a globally diversified ETF, VWRP offers:

-

Broad exposure

-

Professional management

-

Reinvestment mechanics

-

Efficient tracking

—all at a very low annual cost compared to most global active funds.

High-cost global equity funds often struggle to outperform the benchmark. By choosing VWRP, investors maintain broad exposure at minimal cost.

6. One-Fund Portfolio Simplicity

A standout feature of VWRP is that it can serve as a complete, all-in-one investment.

6.1 No Need for Other ETFs

Because VWRP includes:

-

Developed markets

-

Emerging markets

-

Global sectors

-

Multiple regions

…it eliminates the need to combine multiple ETFs, such as:

-

A US fund

-

A Europe fund

-

An EM fund

-

A Pacific fund

-

A UK fund

-

A world ex-something fund

Instead, one ETF does everything.

6.2 Automatic Rebalancing

VWRP continually adjusts its holdings based on:

-

Market capitalisation changes

-

Companies growing or shrinking

-

New companies entering global markets

-

Emerging markets evolving

-

Sector shifts

This automatic rebalancing means:

-

No manual work

-

No timing decisions

-

No need to rebalance yourself

6.3 Perfect for Beginners and Busy Investors

People who want a simple, low-stress, research-free investment approach gravitate to VWRP because:

-

It reduces complexity

-

Minimises research requirements

-

Avoids decision paralysis

-

Streamlines long-term investing habits

With VWRP, creating a long-term strategy becomes significantly easier.

7. Exposure to Emerging Markets: A Major Advantage

Unlike many global ETFs (such as MSCI World trackers), VWRP includes Emerging Markets (EM).

7.1 Why Emerging Markets Matter

Emerging markets represent some of the fastest-growing economies, including:

-

China

-

India

-

Brazil

-

Mexico

-

Indonesia

-

South Africa

-

Thailand

-

Saudi Arabia

These regions often experience higher growth rates than developed nations and may drive global performance in the future.

7.2 Futureproofing Through Market Weighting

Investing in EM individually can be risky, but owning them through a globally weighted index:

-

Dilutes individual country risk

-

Provides exposure to future growth regions

-

Reduces reliance on a single region like the US

VWRP’s inclusion of EM is a major reason why long-term investors choose it over developed-only funds.

8. Psychological Stability and Long-Term Discipline

Investing is as much psychological as financial.

VWRP helps investors avoid common behavioural traps such as:

-

Panic selling

-

Chasing trends

-

Trying to time markets

-

Overconcentrating in certain countries

-

Constantly switching strategies

8.1 Emotional Neutrality

By owning the entire world:

-

You no longer need to predict winners

-

You never feel “wrong” about regional bets

-

You’re always diversified

This reduces stress and keeps investment decisions emotion-free.

8.2 Consistency Encourages Long-Term Holding

When you invest in a simple, diversified, one-fund strategy:

-

You’re less likely to overtrade

-

More likely to stay disciplined

-

More likely to ride out volatility

-

More likely to benefit from compounding

Long-term consistency is one of the biggest factors in investing success

9. Risks and Limitations (Important to Understand)

No investment is perfect. While VWRP is excellent, it still comes with risks.

9.1 Market Risk

VWRP is 100% equities. This means:

-

It can be volatile

-

It may experience temporary drops of 20–50%

-

Investors must be comfortable with short-term declines

9.2 US Dominance

Because market-cap indices reflect reality, VWRP is heavily weighted toward the US. Some investors dislike this concentration, even though it mirrors global markets.

9.3 Currency Risk

UK investors are exposed to:

-

USD fluctuations

-

EUR, JPY, and EM currencies

-

Global exchange rate volatility

Over long periods, currency effects tend to balance out, but in the short-term they can affect performance.

9.4 Equity-Only Strategy

VWRP does not include:

-

Bonds

-

Property

-

Commodities

-

Credit instruments

Investors needing lower volatility typically pair VWRP with bonds or other defensive assets.

10. Who Is VWRP Most Suitable For?

While not advice, VWRP is commonly chosen by:

-

Long-term investors (10+ years)

-

Beginners who want simplicity

-

ISA/SIPP investors seeking tax-efficient compounding

-

Those who value global diversification

-

People who don’t want to manage multiple ETFs

-

Investors comfortable with 100% equity exposure

It’s also popular among those building FIRE portfolios, due to its simplicity and long-term efficiency.

Conclusion: Is VWRP a Good Investment?

For many long-term investors, VWRP is one of the best all-in-one global equity ETFs available. It brings together all the characteristics that academic research shows improve long-term success:

-

Global diversification

-

Low cost

-

Passive market tracking

-

Exposure to both developed and emerging markets

-

Automatic rebalancing

-

Effortless accumulation and reinvestment

-

A simple, easy-to-understand structure

While no investment is perfect, and VWRP certainly carries volatility like any equity ETF, its structure and strategy are rooted in decades of evidence-based, long-term investment principles.

For investors who want:

-

A hands-off global portfolio

-

Strong long-term growth potential

-

Minimal fees

-

No need for stock picking

-

No need for market timing

-

One ETF to do it all

VWRP is frequently considered one of the most intelligent choices available.