Choosing the right broker is just as important as choosing the right ETF. When I first started investing, I didn’t pay enough attention to fees and platform features. Later, I realized that even small costs—like currency conversion charges or hidden account fees—can eat into long-term returns. Below is a breakdown of what to look for and the types of brokers that usually work well for beginners buying VWRP.

What Makes a Good Broker for VWRP

Before naming any specific platforms, it helps to understand the criteria that genuinely matter. These are the same points I wish I had known when opening my first account.

Regulation and Safety

Always choose a broker regulated in your region (FCA, SEC, ASIC, MAS, CySEC, etc.). This ensures your money is protected under strict financial rules. Avoid unregulated apps no matter how attractive they look.

Low Fees

Two costs matter most for VWRP buyers:

Trading commissions

Currency conversion fees

When I switched to a low-fee broker, I immediately noticed how much more efficient my DCA strategy became.

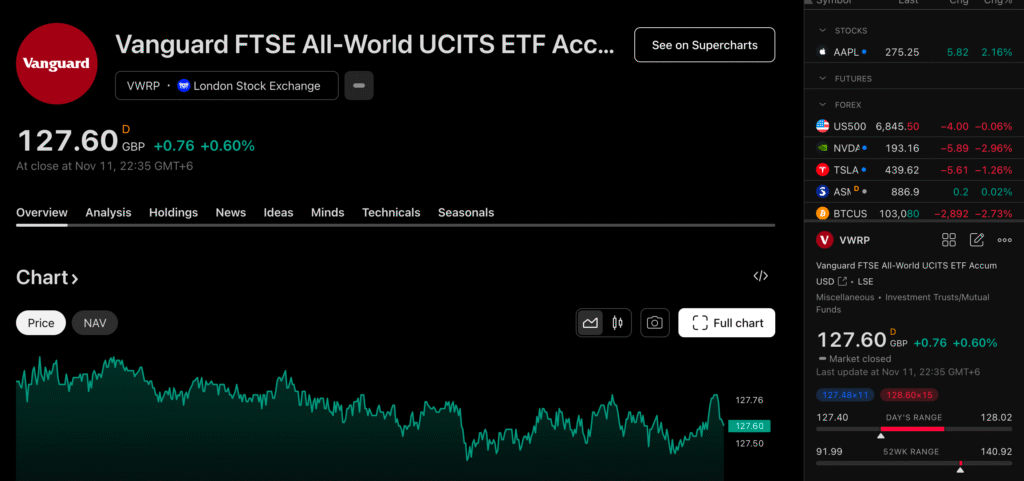

Access to the Right Exchange

Make sure your broker supports the VWRP listing you need, often the London Stock Exchange (LSE).

User-Friendly Platform

As a beginner, I found that having a clear interface made the whole process less stressful. Good brokers offer simple searching, clean charts, and smooth order placement.

Extra Features

Auto-invest, fractional shares, research tools, and low-cost deposits are a plus, especially if you plan to invest regularly.

Popular Broker Types (Choose Based on Your Needs)

Instead of listing specific brand names, here are the categories of brokers most investors use for ETFs like VWRP. You can insert the platforms you partner with later.

Broker Type A — Low-Cost Global Broker (Best for Long-Term Investors)

This type of broker usually offers the lowest trading fees and competitive FX rates. I use one of these for my long-term ETF investments.

Why beginners like this type:

Very low commissions

Tight spreads on major ETFs

Access to LSE and other key exchanges

Good for DCA and long-term portfolios

Pros:

Cons:

Broker Type B — Mobile Investing App (Best for Beginners)

Mobile-first brokers focus on simplicity. When I started, I preferred this type because it felt intuitive and easy to manage from my phone.

Why beginners like this type:

Pros:

Very user-friendly

Quick setup

Good educational tools

Cons:

Broker Type C — Full-Service Broker (Best for Research & Tools)

Some investors prefer platforms that offer strong research, detailed charts, and analyst reports.

Why experienced investors like this type:

Powerful charting

Advanced order types

Detailed market data

Pros:

Cons:

Broker Type D — Fractional Shares Broker (Best for Smaller Budgets)

If you want to invest small amounts regularly, a broker that supports fractional ETFs can be helpful. This allowed me to stay consistent even when prices rose.

Pros:

Cons:

Broker Fee Comparison (What to Check Before You Choose)

Here are the fee categories that matter most. Even without specific broker names, you can use this like a checklist:

| Fee Type | Why It Matters |

|---|

| Commission per trade | Impacts frequent buyers and DCA. |

| FX markup | Affects any ETF listed in a foreign currency. |

| Custody/platform fees | Some brokers charge monthly or yearly. |

| Deposit/withdrawal fees | Adds friction if you invest regularly. |

| Spread | Wider spreads mean slightly worse prices. |

| Minimum deposit | Helpful for beginners with smaller budgets. |

Whenever I compare brokers, FX fees are the first thing I check. Even a small percentage difference adds up over years of investing.

How to Pick the Right Broker for You

Here is a simple way to decide, based on my own trial-and-error experience:

Choose low-cost global brokers if you plan to invest for the long term with consistent contributions.

Choose mobile-first brokers if you prefer simplicity and ease of use.

Choose full-service brokers if research tools and advanced features matter to you.

Choose fractional brokers if your monthly investing budget is small.

The best broker is the one that fits your investing habits, not necessarily the one with the lowest headline fee. Consistency matters more over the long run than squeezing every tiny percentage point from costs.

A reliable, affordable broker makes buying VWRP easier, cleaner, and more cost-efficient—especially if you’re building a long-term global portfolio.